Are you ready for house prices to dip?

Industry analysts predict a fall in house prices in 2023 after a 24% increase over the past 32 months. Learn what this means for your next property purchase.

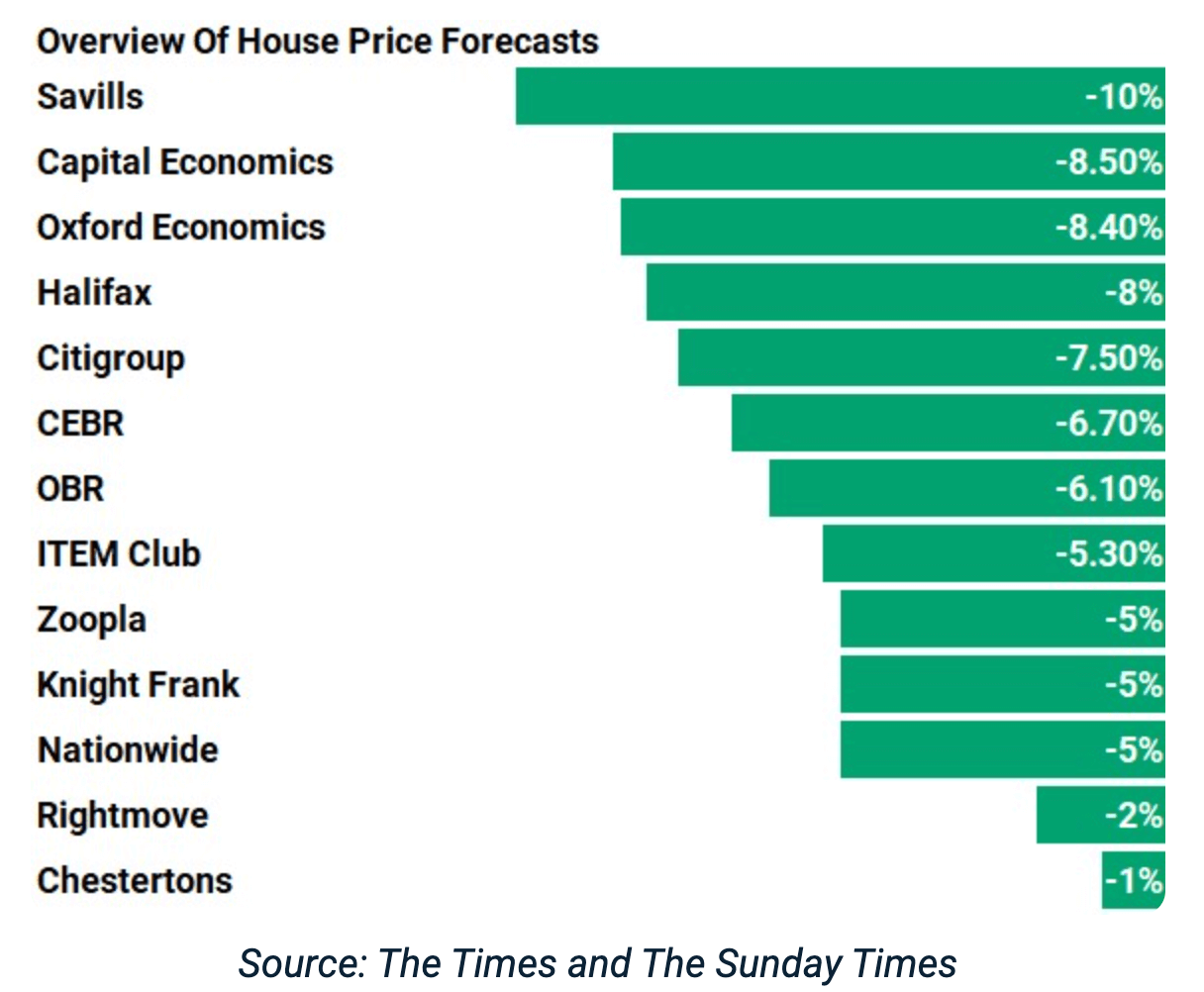

The Property Price Consensus

A general consensus among 13 sources surveyed is that UK house prices will likely decrease in 2023. The forecasted price drops range from 5% to 8% (with an average of 6%) across the market.

However, it’s important to note that this decline is often just a correction to the significant increases seen over the past two years. Asaam, Halifax Home’s director, highlights some of the most crucial house price increases the market saw between March 2020 and August 2022. The average house price increased by almost £55,000 (23%), reaching a record high of £293,992.

Despite the projected fall in house prices, Robert Gardner, Nationwide’s Chief Economist, suggests a good chance of a soft landing in the property market. He believes the risks are skewed to the downside, but it’s still possible to achieve a relatively soft landing next year with activity stabilising modestly below pre-pandemic levels. House prices may also gradually decrease by around 5%.

It’s worth noting that the UK is not one homogenous housing market when predicting house price changes. Instead, it comprises countless smaller regional markets, each with its dynamic influencing its performance. Savills, for example, expects the most severe falls in house prices for 2023 to be in London and the South East, with a decrease of between 11 and 12.5%. In contrast, Savills forecasts that house prices in the North West, North East, Yorkshire and the Humber regions will only decrease by 8.5%.

Savills also believes that the Prime housing market, or the top end, may be more resistant to falling prices. Central London houses are projected to fall by only 2%.

Factors Affecting Prices

The decline in house prices may be due to various factors, which have worsened due to the pandemic. The pandemic has led to a rise in inflation, which has compelled the Bank of England to raise the Bank Rate from its historically low levels. Additionally, household costs, such as energy bills, are likely to increase, putting a strain on family budgets. These financial pressures, higher mortgage rates, and the cost-of-living crisis will likely result in fewer first-time buyers and buy-to-let investors. This will reduce the demand side of the equation, leading to lower house prices.

The outlook for property transactions in the year ahead

The number of home sales is an essential indicator of the UK’s housing market’s health. Savills has predicted that the number of home sales, which was 1.1 million in 2022, will remain at least 900,000 in 2023. However, there is some positive news: December’s Rightmove data showed an 11% increase in the number of views for homes for sale compared to the previous year.

Will House Prices Bounce Back in 2024?

The outlook for house prices in 2024 is uncertain and depends mainly on the severity of the decline in 2023. Savills predicted a significant recovery in all regions between 2024 and 2027. However, the OBR suggests that house prices will continue to fall in 2024, with a combined decrease of 9% over two years. Similarly, Knight Frank forecasts that house prices will decline by another 5% in 2024 before starting to pick up again in 2025 and rebounding more significantly in 2026.

In summary, it is hard to predict the state of the British property market in 2024. While the house price downturn starting in 2023 might worry some, it is essential to remember that many factors are in play, and such corrections are not uncommon.

TENANCY AGREEMENT

SECTION 21 NOTICE

RENEWAL OF TENANCY AGREEMENT

SECTION 8 NOTICE

LODGER AGREEMENT

COMPLETE LANDLORD PACK

PROPERTY INVENTORY

COMPANY LET AGREEMENT

ABOUT US – TESTIMONIALS – PRIVACY POLICY – TERMS AND CONDITIONS – CONTACT US

© 2023 Tenancy Agreement UK. All Rights Reserved.